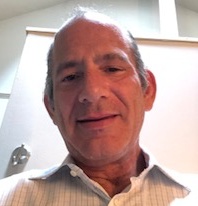

Mrs. Schiff is a Founder and Managing Partner of MREC Management, LLC and serves as the functional COO of Mosaic and is a member of the Investment and Executive Committees.

- Risk analysis of investing in leisure and entertainment real estate amidst COVID-19.

- A six-month forecast of demand scenarios, emerging macro trends, key opportunities and an overview of the investment cycle.

- Determining key steps to achieve future market resilience across the sector.

- Assessing the impact of COVID-19 on the investment landscape and creating a pathway for recovery.

- Models to finance growth through the completion of sale-leaseback transactions with real estate investors.

- Growth strategies and portfolio management at the lowest risk

- Determining short, medium and long-term market impacts on the sector.

Moderator

Vicky Schiff

Founder, Managing Partner & COO

Mosaic Real Estate Investors

Read Profile

Vicky’s investment career began in the early 1990s as an acquisitions and diligence executive for Summit Commercial/Highridge Partners in Los Angeles, where she worked on approximately $1B in transactions.

Vicky is a career entrepreneur, co-founding five firms since 1996 including a real estate investment and development company with over 100 employees in the self-storage industry; a $400M+ institutional real estate fund of funds with a sub-strategy of supporting women and minority emerging real estate firms throughout the US; a national boutique investment banking firm which raised over $6B from institutional investors for top-tier real estate and private equity firms around the world. In 2010, post global financial crisis, she founded Oro Capital Advisors to create value for investors acquiring commercial real estate debt and distressed assets in target markets across the United States acquiring and managing industrial, retail, office and multi-family properties.

Vicky previously served a three-year term as a Commissioner for the Los Angeles City Employees’ Retirement System and has served on the board of two publicly traded and 2 family owned real estate related companies. In addition, she has served on several not for profit Advisory Boards including the Rogert Toigo Foundation, various YPO boards, and the USC Lusk Center of Real Estate. She earned a Bachelor of Science degree from the University of Southern California and a Master’s in Business Administration from The Anderson School of Management at UCLA.

Panelist

Jess Gupta is Corporate Development Manager at NetSuite, and a partner at Everest Group.

Yesh Gupta

Business Development

Everest Group of Companies

Read Profile

At NetSuite, Jess is responsible for managing the process around strategic M&A and investments. Jess was previously with Infogroup, where he was in the Business Development group from 2004 to 2008. Jess received his bachelor's degree from New York University in 2002, and a law degree from the University of San Francisco School of Law in 2011.

Panelist

Christopher Beavor is the CEO and founder of CAI Investments, LLC (“CAI”). CAI’s mission statement is “Developing Trust Through Transparency and Vision”.

Christopher Beavor

CEO/Founder

CAI Investments

Read Profile

Mr. Beavor embodies that statement. He manages and controls the Sponsor and manages and controls the Manager. CAI is based in Las Vegas, the hotel capital of the world. Early in his career, in the late 1990s, he was involved with the development of the Luxor Hotel and Mandalay Bay resorts and projects including the Gold Strike Hotel and Casino in Tunica, Mississippi. In the mid-2000s, Mr. Beavor was involved in the $800 million Hard Rock Hotel condominium development in Las Vegas. As a principal from 2005 to current, Mr. Beavor was involved in the development of a wide range of projects, such as a 72-unit luxury condominium hotel project called the Ski Lofts in Brian Head Utah, a luxury condominium with 45-units in Toluca Lake, California, and entitled and zoned the largest tourist hotel, gaming and marina in Europe. Mr. Beavor, by way of CAI, repositioned the Sheraton Bay Point Resort, which won the 2016 Marriott International North America reward for best reposition, receiving a 4-star rating for its $30 million renovation. The 300-plus acre resort is one of the largest in the United States and is located in Panama City, Florida. The Bay Point consists of 320-rooms, a private beach, two 18-hole golf courses designed by (Jack) Nicklaus Design, and a state-of-the-art 40,000 sq. ft. convention center. Locally in Las Vegas, CAI also entitled and sold a hotel project adjacent to the Las Vegas NASCAR speedway.

In addition to hotels, Mr. Beavor develops national brand NNN-leased retail throughout the southwest and is the founder of a successful real estate brokerage firm that manages property for institutional investors. In Q4 2016, CAI purchased a 10-acre unimproved property zoned for a resort use from the Lehman Brothers Estate next to the Palms Hotel and Casino. CAI fast tracked the entitling and subdividing of the property (now under construction). The $200-plus million development consists of national retailers, an 18-story international branded hotel and 287 high end apartments. Mr. Beavor has crafted a network of relationships with real estate investors, sellers and brokers, allowing him (as the Sponsor) to acquire and complete over hundreds of real estate transactions over the past 10 years under the Sponsor umbrella. Having handled thousands of completed real estate transactions over the course of the past decade, Mr. Beavor has been an advisor and operating partner in the identification, acquisition, repositioning, and managing of real estate assets and properties for numerous companies, including Fannie Mae, Archbay Capital, Freddie Mac, and GTIS Partners. Mr. Beavor has developed over hundreds of millions of dollars in projects within the United States and Europe. He and his companies manage over 1,000 real estate assets for hundreds of clients, ranging from large NYC-based institutional investment funds to high net worth family offices and individuals. In addition to hotels, CAI acquires and develops NNN-leased, income properties nationally through DST Reg D offerings.

Panelist

Leslie Lundin is co-founder and Managing Partner of LBG Real Estate Companies, LLC. Leslie is primarily responsible for overseeing all aspects of capital raising and reporting, as well as acquisitions, asset management, due diligence and documentation of LBG transactions.

Leslie Lundin

Founder & Managing Partner

LBG Realty Advisors

Read Profile

Prior to co-founding LBG, Leslie was Senior Vice President for Inland Mortgage Capital Corporation, in charge of their national opportunistic debt investment program which she formed in 1995. Leslie directly oversaw all of Inland’s origination offices, directed all marketing of the program, oversaw the pre-approval process of pending loans, and was engaged in strategic investment decisions to determine the direction of the program. Before joining Inland, from 1990-1995, Leslie was a lender at ITT Real Estate Services, where she originated participating bridge and construction loans. In 2014, Leslie was named as one of Bisnow’s Los Angeles Power Women in CRE and has been nominated as one of East Bay CREW’s Most Influential Women in CRE. She was also named as one of Real Estate Forum’s 2009 Women of Influence and one of Southern California’s Most Influential Women by Real Estate Southern California Magazine in 2005, 2006, 2007 and 2008. She is frequently published and interviewed by industry periodicals and routinely speaks at industry conferences, including ICSC, NAIOP, Crittenden, Realshares, IMN, iGlobal, Trigild, Biznow, CREW, ACRE and Women’s Leadership Counsel. From 2007 to 2009, Leslie was Chair of the ICSC/NAIOP Capital Marketplace Conference held annually in New York and now serves on the committee. She chaired the 2010 and 2011 ICSC/NAIOP/LAMA Capital Marketplace West Conference (one that she started). She is also on the first ever ICSC Recon Committee and the Chair of the ICSC International Capital Markets Committee. Leslie also chairs the Final Frontier Conference: a Seminar on Women as Entrepreneurs in Commercial Real Estate, which she conceived of in 2009. Leslie received a Master of Science degree in Real Estate Appraisal and Investment Analysis and a Bachelor of Arts degree in Comparative Literature and Communication Arts with a Minor in French from the University of Wisconsin-Madison. She is also a licensed California real estate broker.

Panelist

John’s experience spans 30 years in real estate and capital markets. Former Group Managing Director at Fitch Investors Service, where he was responsible for the U.S. Structured Finance area.

John Bonfiglio

Founder

Stone Bridge Investment Group

Read Profile

Former head of Fitch’s commercial mortgage and REIT groups. At Fitch, John was responsible for over $500 billion of rated commercial mortgage loans during this period. Former Vice President with The O’Connor Group, where he was responsible for purchasing $800 million of commercial properties. John has a BA in Finance from the Wharton School of the University of Pennsylvania and an MBA from Columbia University.

Panelist

Tony Fox, Esquire, President of ADF Capital, Ltd., was educated at the University of Colorado, Honors Program, BA cum laude in philosophy, and at DePaul University where he received his JD/MBA degrees. He is a licensed lawyer and real estate broker.

Tony Fox

Owner and President

ADF Capital

Read Profile

He founded ADF Capital in 1999 and now owns and operates five neighborhood shopping centers, each about 20,000 square feet. Within one of them, Tony developed and operates a movie theater, the New 400 Theater. He has also recently developed The Harper Theater, a movie theater/cafe in Hyde Park, which he operates in partnership with the University of Chicago. The Harper Theater has recently earned the Illinois Landmarks Restoration Award. Tony has dedicated much of his life working in public service. First, as a clerk at the United States Department of Justice; second, as a prosecutor at the Cook County State’s Attorney’s office; and third, as a zoning commissioner for the City of Evanston Zoning Board of Appeals. Currently, Tony is serving as a Chicago Commissioner (Sheridan Devon Special Services Area in Rogers Park and another one in Hyde Park) and is a Retail Specialist for the Chicago Metropolitan Planning Council (MPC)’s Bronzeville Initiative, a plan to earmark hundreds of millions of future federal, state and local development dollars. In his free time, Tony competes regularly in Brazilian Jiu-Jitsu tournaments. He is a Purple Belt and a prior Chicago Open Champ. He lives in Evanston with his wife, Wendy and his two sons, Izzy and Charlie.

Panelist

William “Billy” Procida Founded Procida Funding and Advisors in 1995 and has financed, fixed and built over 3 billion dollars of buildings and companies.

Billy Procida

Founder

Procida Funding & Advisors

Read Profile

Procida manages the 100 Mile Fund which provides financing for commercial real estate projects and small to mid size businesses. His awards over the years include: Rockland County, New York Citizen of The Year New York City Developer of The Year National Home Builders Pillar of the Industry Award Institutional Investor Non-bank Lender of the Year Bronx Business Man of the Year New York Mortgage Bankers’ Man of the Year New Jersey Gold Coast Business Man of the Year American Jewish

Media Partners

Read Profile >

Family Office Networks is a unique collection of different Family Offices located throughout the world that is able to bring the financial industry and financial professionals to various single family and multi-family office locations. We are able to offer a diverse list of financial management services to millions of wealthy individuals and their families. For more information, please visit familyofficenetworks.com

Read Profile >

SmartMoneyMatch connects the global investment community.

It’s free to use and offers the following opportunities. Go to:

- SmartMoneyMatch.com/investmentsto browse and to list investment products.

- SmartMoneyMatch.com/investorsto find investors, list a Request for Proposals (RFPs), or reply to one.

- SmartMoneyMatch.com/service-providersto find investment service providers with the required expertise or to list your offerings.

- SmartMoneyMatch.com/business-directoryto browse organizations and present yours.

- SmartMoneyMatch.com/eventsto search for and to announce events.

- SmartMoneyMatch.com/jobsto browse for jobs or to list your vacancies.

- SmartMoneyMatch.com/peopleto find and connect with other professionals.

Additionally, all users have a company and a personal profile page where their activities or offerings—as an asset manager, investor, or service provider—are displayed.

Register now free on https://www.SmartMoneyMatch.com

Read Profile >

Savvy Investor is a world-leading content platform for institutional investors and service providers. Our dedicated Content Team curate the best investment articles and whitepapers from across the globe bringing them all together in one place for the ease of our members.

Registration is free! Sign up today to browse the latest papers on Real Estate, Private Equity, Debt and Credit Outlook and much more; or take a look at our Asset Management Salary Surveys and Savvy Blogs.

CONTACT US

Mailing Address

6 East 43rd St19th Floor

New York, NY 10017

Contact Information

Tel: (212) 752-7760info@iglobalforum.com

© 2020 iGlobal Forum. All rights reserved to the respectful owner.